“Across the department and indeed across the globe, we are handling corporate investigations that involve sanctions evasion — in industries as varied as transportation, fintech, banking, defense and agriculture,” said Monaco in a speech earlier this year. She added that the DOJ is bringing in 25 new prosecutors to investigate and prosecute sanctions evasion, export control violations and similar economic crimes. (See “Deputy Attorney General Lisa Monaco Delivers Remarks at American Bar Association National Institute on White Collar Crime,” Department of Justice, March 2, tinyurl.com/mmunnmt7.)

Low-cost solutions to sanction risks

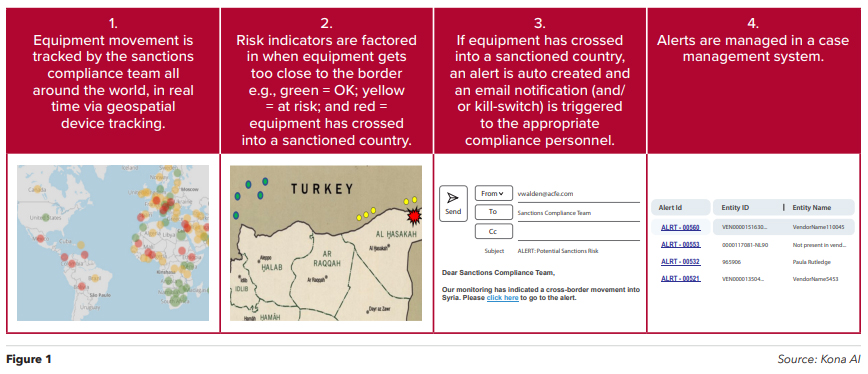

Against that backdrop, organizations must become more vigilant in detecting potential sanctions violations. Technology offers one solution. For instance,

the company involved in the introductory case could’ve installed low-cost geotracking devices on all their heavy equipment, allowing it to track geospatial movements in real time through a compliance monitoring platform. As soon as a tractor crossed the border into Syria, or any other sanctioned country for that matter, company executives could receive an alert in real time and immediately fire an email to their compliance personnel. They could also perhaps send a “kill-switch” message to

the machine’s central computer and shut down the motor altogether, making it inoperable while in the restricted zone. Because the compliance monitoring platform is tied into the company’s order-to-cash/customer sales system, the equipment’s model number, contract and information on who purchased the equipment is readily available. Now, for around $10 to $20 per tracking device, all the company’s heavy equipment is tracked in real time and their sanctions exposure is virtually eliminated, as demonstrated in Figure 1.

Scott Wright is a senior managing director for global investigations at consulting firm J.S. Held and a recent senior executive retiree from the Central Intelligence Agency’s Directorate of Operations. He says that while geospatial analysis is hardly new, it’s now widely used and has proven to be an effective tool in imposing sanctions policies and programs.

“Leveraging technical means to monitor and support sanctions compliance is an increasingly important kitbag item,” he adds. “In fact, the U.S. National Geospatial-Intelligence Agency exists to deliver world-class geospatial intelligence that provides a decisive advantage to policymakers, warfighters, intelligence professionals and first responders.” (See “National Geospatial Intelligence Agency,” nga.mil.)

Wright, who operated in the foreign field for decades, says the misuse of sanctioned equipment remains a problem across the globe and needs a durable solution with teeth.

“Utilizing geospatial tracking takes your program one step further on the technical compliance maturity spectrum,” he says. “And much like ubiquitous golf cart technology, the geospatial tracker, using preset GPS coordinates, can trigger the equipment to fail — via a kill-switch, for example — once aforesaid coordinates are breached.”

Broader uses of geospatial technology

As I reflected on this example, I began to think about other use cases. Heavy equipment is certainly a good one, but what about other items that we don’t want to see fall into our adversary’s hands? Sensitive telecommunications equipment, high-powered servers, routers, and aerospace and defense equipment all fit this category. I’d be surprised if the aerospace and defense industry doesn’t already have geospatial technology in place, albeit probably top secret. The point is, if sanctions compliance is the new FCPA in terms of enforcement, and we’re all aware of the billions in fines government officials have levied against those violations, then we need to rethink how our companies are preparing to mitigate sanctions risks.

Policies and procedures are often not enough when it comes to ensuring compliance. Technology use cases, such as geospatial analysis, can provide nearabsolute certainty that equipment or materials don’t cross restricted borders — so long as you hide the device or embed it into the system so that it can’t be disabled or removed without triggering an alert. Naturally, organizations also need to consider the contractual language of the deal, and any data privacy issues or restrictions around monitoring such equipment. But in most cases, these issues can be addressed with preplanning and disclosures upfront.

“From an application development perspective, there are so many great use cases for real-time geospatial data feeds for compliance monitoring platforms,”

says Rama Udathaneni, senior manager and software engineer at DCube Data Sciences Corp.

“For example, we’ve monitored delivery truck movements to identify rogue routes or fake customer schemes, as well as programming ‘out-of-bounds’

perimeters to shut down company equipment if they stray off course or cross into restricted areas. All of this can be programmed via longitude and latitude coordinates that can also initiate risk triggers to the business or compliance personnel.”

With the current conflict in Ukraine, tensions in East Asia and other conflicts around the world, it’s important that all companies participating in global commerce be aware of such sanctions and have a measurable, datadriven compliance program to mitigate these risks. Geospatial analysis may be a cost-effective technology that can significantly help. FM

Vincent M. Walden, CFE, CPA, is the CEO of kona AI, an AI-driven anti-fraud and compliance technology company providing easy-to-use, cost-effective payment and transaction analytics software. Contact him at vwalden@konaai.com

This article was originally published in Fraud Magazine on July/August 2023.